An investor can apply BVPS to a stock by analyzing the company’s balance sheet. Specifically, an investor will need total asset value, cost of acquiring an asset, and accumulated depreciation of corporate assets which helps provide the most accurate BVPS figure. The Book Value Per Share provides information about how the value of a company’s stock compares to the current Market Value Per Share (MVPS), or current stock price. For example, if the BVPS is greater than the MVPS, the company’s stock market may be undervaluing a company’s stock.

How to Increase Book Value Per Share

Using the same share basis formula, we can calculate the book value per share of Company B. Book Value Per Share also theoretically reflects what shareholders would receive in a company liquidation after all its assets were sold and all of its liabilities paid. However, because assets would hypothetically sell at market value instead of historical asset values, this may not be an entirely accurate measurement. Companies with lots of machinery, like railroads, or lots of financial instruments, like banks, tend to have large book values. In contrast, video game companies, fashion designers, or trading firms may have little or no book value because they are only as good as the people who work there. Book value is not very useful in the latter case, but for companies with solid assets, it’s often the No.1 figure for investors.

Online Investments

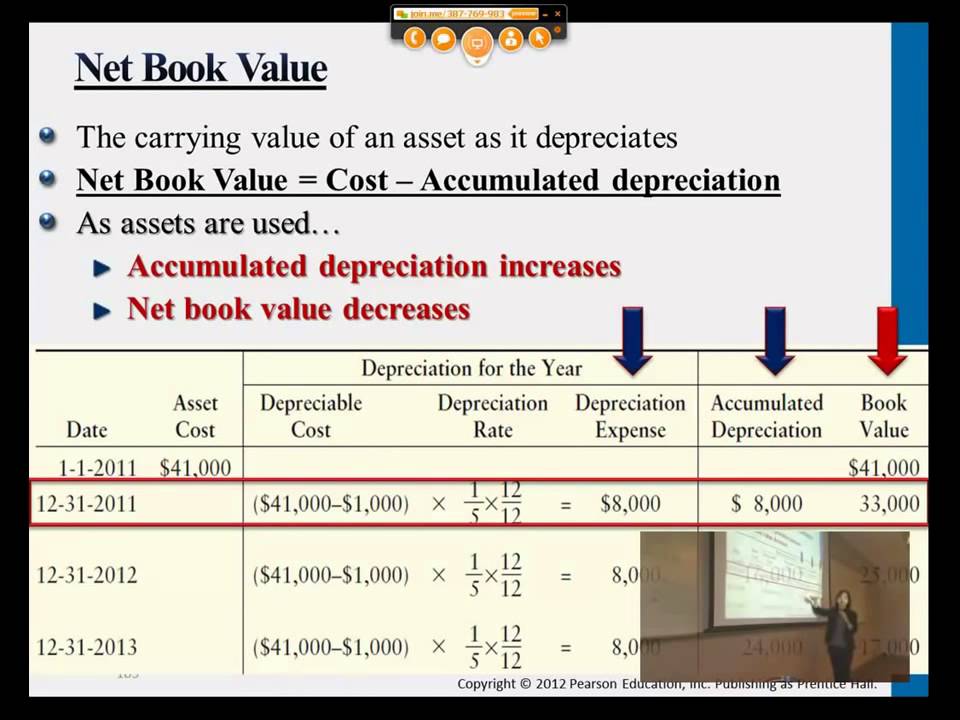

Carrying value is the asset’s original cost less any accumulated depreciation or amortization. Accumulated depreciation is the aggregate depreciation recorded against that asset during its lifetime. The book value per share of a company is the total value of the company’s prepaid expenses meaning journal entry and examples net assets divided by the number of shares that are outstanding. In theory, a low price-to-book-value ratio means you have a cushion against poor performance. Outdated equipment may still add to book value, whereas appreciation in property may not be included.

Is Book Value a Good Indicator of a Company’s Value?

BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. BVPS is significant for investors because it offers a snapshot of a company’s net asset value per share. By analyzing BVPS, investors can gain insights into a company’s financial health and intrinsic value, aiding in the assessment of whether a stock is over or undervalued.

- A common way of increasing BVPS is for companies to buy back common stocks from shareholders.

- The fair value of an asset reflects its market price; the price agreed upon between a buyer and seller.

- It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

- Yes, if a company’s liabilities exceed its assets, the BVPS can be negative, signaling potential financial distress.

- Finding those bargains can be challenging because stocks that are obviously underpriced tend to self-correct quickly.

In other words, the market doesn’t believe that the company is worth the value on its books. Mismanagement or economic conditions might put the firm’s future profits and cash flows in question. The examples given above should make it clear that book and market values are very different. There are three different scenarios possible when comparing the book valuation to the market value of a company.

Manufacturing companies offer a good example of how depreciation can affect book value. These companies have to pay huge amounts of money for their equipment, but the resale value for equipment usually goes down faster than a company is required to depreciate it under accounting rules. If it’s obvious that a company is trading for less than its book value, you have to ask yourself why other investors haven’t noticed and pushed the price back to book value or even higher. The P/B ratio is an easy calculation, and it’s published in the stock summaries on any major stock research website. A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0.

However, you would need to do some more research before making a final decision. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

The Bottom Line Using book value is one way to help establish an opinion on common stock value. Like other approaches, book value examines the equity holders‘ portion of the profit pie. Unlike earnings or cash flow approaches, which are directly related to profitability, the book value method measures the value of the stockholders‘ claim at a given point in time. An equity investor can deepen an investment thesis by adding the book value approach to his or her analytical toolbox. Measuring the Value of a ClaimA good measure of the value of a stockholder’s residual claim at any given point in time is the book value of equity per share (BVPS). Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities).

It also may not fully account for workers‘ skills, human capital, and future profits and growth. The value of a common stock, therefore, is related to the monetary value of the common shareholders‘ residual claim on the corporation – the net asset value or common equity of the corporation. A company’s stock buybacks decrease the book value and total common share count. Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share.

If the market price for a share is higher than the BVPS, then the stock may be seen as overvalued. A negative book value means that a company’s liabilities are greater than its assets. On the other hand, value investors might look for a company where the market value is less than its book value hoping that the market is wrong in its valuation. Making Calculations Practical Now it’s time to use the calculation for something. The first thing one might do is compare the price/BVPS number to the historic trend. In this case, the company’s price/BVPS multiple seems to have been sliding for several years.

Kommentare von reda