Return on Common Equity (ROCE) is a key financial metric that measures the profitability and efficiency of a company by assessing the returns generated from its common shareholders‘ equity. A company can improve its return on common stockholders‘ equity through initiatives such as cost-cutting, increasing sales, optimizing asset utilization, or paying down debt. Each strategy aims to bolster profitability or efficiency, thus potentially enhancing the returns to common shareholders. Because shareholders‘ equity is equal to a company’s assets minus its debt, ROE is a way of showing a company’s return on net assets. However, shareholders’ equity is a book value measure of equity, not the equity value (i.e. market capitalization).

Interpreting ROCE

ROE is also used for comparative analysis, allowing investors to compare efficiency across different firms or within the same firm over different periods. Remember, a ROCE that is substantially higher than sector peers might indicate not only operational excellence but also potential financial leverage or risk factors that merit closer examination. If a company has been borrowing aggressively, it can increase ROE because equity is equal to assets minus debt. Investors can use ROE to estimate a stock’s growth rate and the growth rate of its dividends. These two calculations are functions of each other and can be used to make an easier comparison between similar companies.

Factors Affecting ROE

- If shareholders’ equity is negative, the most common issue is excessive debt or inconsistent profitability.

- While a higher ROCE generally indicates better performance, it is essential to compare it with industry benchmarks and consider other factors to assess a company’s overall financial health.

- ROCE measures the profitability and efficiency of a company’s operations and is a valuable tool for evaluating its financial performance.

- In this case, preferred dividends are not included in the calculation because these profits are not available to common stockholders.

- After that, we looked at how this formula is used and what to pay extra attention to when using it.

- Benchmarking against industry averages aids in assessing a company’s performance against its competitors.

ROE is sometimes used to estimate how efficiently a company’s management is able to generate profit with the assets they have available. Therefore, investors should analyze ROCE in conjunction with other financial metrics and industry benchmarks. In this section, we will compare ROCE to other financial metrics to uncover its strengths and limitations. This comparison underscores how different metrics can complement one another to enhance the accuracy of profitability assessments. All these situations highlight the importance of not solely relying on ROCE and reported profits to gauge a company’s financial health. Dividends are influenced by factors beyond profitability, emphasizing the need for a more comprehensive assessment.

Using Return on Equity to Identify Risks

Nevertheless, understanding the underlying principles of ROCE calculation remains invaluable for anyone serious about financial analysis. For businesses aspiring to uplift their ROCE, the dual approach of optimizing net income and efficiently managing equity comes into play. Delving into the calculation of ROCE reveals a straightforward, albeit meticulous process. It begins with identifying the Net Income, typically located prominently on the income statement.

Return on Equity (ROE) Ratio

Each year, net income is growing by $2m for both companies, so net income reaches $28m by the end of the forecast in Year 5. Company A has an ROE of 40% ($240m ÷ $600m), but Company B has an ROE of 30% ($240m ÷ $800m), with the lower ROE % being due to the 2nd company carrying less debt on its B/S. Therefore, the fact that the company requires fewer funds to produce more output can lead to more favorable terms, especially in early-stage companies and start-ups.

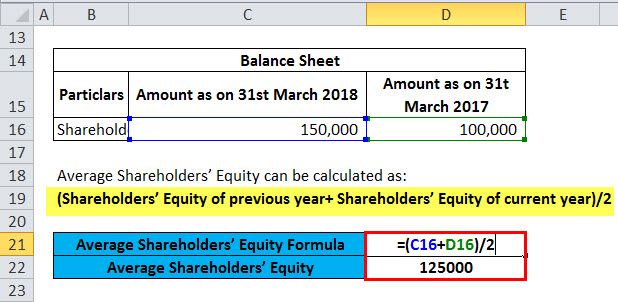

How to Calculate ROE

ROA measures the company’s ability to generate profits from its assets, while ROCE indicates how efficiently a company is using its capital to generate profits. There are several ways a company can improve its ROCE, including increasing sales revenue, reducing expenses, and improving profitability. Additionally, a company can raise more capital from common stockholders or increase its borrowing capacity to invest in new projects or expand existing operations.

Since shareholders’ equity is equal to a company’s total assets, less its total liabilities, ROE is often called the “return on net assets”. So a return on 1 means that every dollar of common stockholders’ equity generates 1 dollar of net income. This is an important measurement for potential investors because they want to see how efficiently a company will use their money to generate net income. It involves the company’s net income and the average common equity over a specific period.

Net Income is the profit a company earns after all its costs, expenses, and taxes have been subtracted from total revenue. Now, assume that LossCo has had a windfall in the most recent year and has returned to profitability. The denominator in the ROE calculation is now very small after many years of losses, which makes its ROE misleadingly high. Therefore, it’s crucial to evaluate a company’s debt levels and its ability to pay off its obligations. However, the differences that cause the ROE of the two companies to diverge are related to discretionary corporate decisions.

Of course, nothing is ever equal when it comes to comparing different companies, even if they operate in the same industry and sector. By implementing practical strategies, you can improve your investment portfolio and boost your returns. The best value of ROE is roughly several dozen percent, but such a level is difficult to reach and then maintain. The absorption costing and variable costing explained higher the ROE of a company, the firmer and more beneficial its situation on the market. Across the same time span, Company B’s ROE increased from 15.9% to 20.2%, despite the fact that the amount of net income generated was the same amount. The two companies have virtually identical financials, with the following shared operating values listed below.

Return on equity is also similar to earnings per share or EPS, which is a great way of tracking earnings across time. Yet because EPS depends on the number of shares, it’s not easily comparable across different companies. We subtract preferred dividends from net income because by definition these dividends are not part of the returns that accrue to regular stockholders. However, this strategy can also pose risks to the company’s financial health, especially if it takes on excessive debt that it cannot service. It is important to compare a company’s return on equity to that of other companies within the same industry to determine whether it is performing well or not. Therefore, it is crucial to compare a company’s return on equity to that of other companies within the same industry.

Kommentare von reda